And what to buy instead

by Carly Susic

Buying off the plan? Please don’t! We’ve seen so many disasters first-hand. Here’s our reasons why we don’t recommend buying off the plan. Save your well-earned dollars for a safer investment.

1. You can’t experience the property in person

Some homes have a great feel. Some don’t. When buying off the plan, you get no chance to stand in the rooms and experience the atmosphere, the room dimensions, the view or the general vibe of the property. A room might seem a great size on paper, but only in person you realise it’s too small. It’s difficult to get a sense of a home based on a drawing. Display suites are helpful, but will unlikely be kitted out like your final property.

2. Poor construction

This obviously varies from builder to builder. But as Four Corners reported recently,

Four Corners investigates Australia’s apartment building crisis, from shoddy workmanship to lax laws, leaving owners out of pocket and in some cases out of a home altogether

But there’s plenty of corner cutting going on. Builders might skimp on your paint coatings. We’ve seen plenty of new developments suffer cracks in the external rendering. Plumbing can be shonky, leading to water ingress. Damp is a huge problem to fix and the builder will be sailing off into the sunset, potentially leaving you to fix the damage.

3. Changing finance or circumstances

When you buy off the plan you will be signing the contract well before settlement. By the time you settle, financial circumstances may have changed. Due to the banking royal commission, lenders are getting stricter on applicants. Banks may decide your loan is no longer reflective of the property value. The other risk is that your personal circumstances change – you may lose a job, grow your family or even have a change of heart. Then, you’re stuck with a purchase you can’t finance, meaning you’ll have to forfeit your deposit or find a lender who may charge you very high interest rates.

4. Delays are common

The developer promises you it will be built in twelve months. But once you’ve signed the contract, you could find that it’s delayed. It’s very common for developments to fall behind schedule. You could be waiting years for your property to be built. Builders and developers often go broke, which causes further delays.

5. You can get stuck if the market changes

If you are hit with a delay, or even during the original timeframe expected the real estate market can change in that time. This can affect what your home is worth before you even get the keys in the door. If you bought off the plan in 2017, it is safe to say it is worth less in today’s market. But if you’re settling on the 2017 price in a 2019 market, you’re punished financially and unlikely to recover your money if you need to sell it.

6. Fees and rates ambiguity

When you’re buying off the plan, you have no idea what the body corporate fees and council rates will be. Let me tell you: high! There’s lifts, underground parking and grounds that require extensive maintenance, not to mention the maintenance of the pool and gym that was used to lure you into the lifestyle! You could be paying thousands in body corporate fees. Plus, who knows what the council will charge you in rates? It is often much higher than you estimate.

7. The buying off the plan stamp duty myth

Many buyers are attracted to buying off the plan for the stamp duty savings. That’s true. But, even with the saving, the risks are not worth it. The saving in stamp duty is lost in the poor value of the investment. Developers can also use this as a selling tool to make the property look like a good deal and add what you are saving in stamp duty to the price. If there were two properties before me, equal in features, location and value and one was an off the plan and the other was established, I would pay the stamp duty.

8. Oversupply

There’s simply far too many off-the-plan properties on the market at the moment. Newly created residential growth zones around transport and shopping hubs as well as areas like Docklands, Southbank and Richmond have cranes on every corner. Oversupply leads to low prices. If you decide to sell in five years’ time, you could be competing with even more brand new apartments. Who would buy something five years old when they can get a brand new property for the same price or less? Essentially, oversupply makes it harder for you to sell for a profit later on.

9. Mistakes

The other problem is mistakes. Often builders don’t build to your requirements, changing room sizes if necessary. We recently helped a client sell his off-the-plan purchase. Upon his pre-settlement inspection, he found that some upgrades were missed. A double sink in the bathroom was missing. He had paid extra for floating floors that he expected to be the same as the display suite but were obviously a lesser quality.

After seeking advice from his solicitor he was advised that he had no choice but to settle and inform the developer in which they had several months to respond or rectify. Builders don’t tend to fix problems like this. They may compensate you for the mistakes but you would likely have a fight on your hands to get it. Then, you’re left with a property lacking the extra features you paid for.

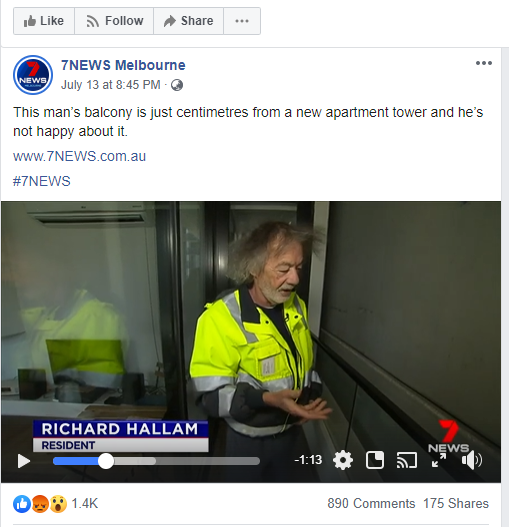

10. Nearby developments destroy your value

Your lovely balcony view (and your resale price) can be ruined if a development crops up next door. Admittedly, this can happen anywhere. But, it’s more likely in in high-growth areas earmarked for future development. Seven News Melbourne recently reported on a case where an owner lost his views and natural light due to a building next door just eleven centimetres away. (It’s clearly an issue that many Melburnians worry about – there’s almost 900 comments on the Facebook post.)

Janet and Paul’s story

Last year Paul approached us after a series of problems with his off the plan purchase. The couple wanted to downsize from their large family home and snapped up a lovely ground floor flat in Carnegie. But the builders went broke – twice! The promised 15-month construction lagged behind schedule for three long years. Each time Paul and Janet were told a completion date, it was pushed back. Unfortunately during this delay, Janet became unwell. The move to a new suburb would be difficult for Janet who needed time to familiarise herself with her new home to stay independent.

It was decided they’d be better off moving quickly so that Janet had as much time as possible to get to know her new home while her health allowed. We were able to help Paul and Janet recoup some of their funds by selling quickly once they gained possession – but sadly, the value of the property had decreased as the market dropped, so they didn’t recoup all their funds.

What to buy instead?

So, you’ve listened to our advice and you promise never to buy off the plan? We suggest you buy rarity. What does this mean? It means apartments are blue-chip older properties built in the 50s, 60s or 70s. Sure, some of those brown brick apartment blocks or units may not be pretty, but they are well built and sturdy. They’ve got higher ceilings, bigger rooms and plenty of often value add potential. A general rule of thumb is if you’re competing to buy it then you’ll have buyers competing for it when you decide to sell.

If you’re thinking of buying please contact us for a chat first! We’ll make sure you don’t buy something you regret.