by Melbourne buyers’ advocate, Carly Susic

Have you been surprised by a house offer letter from an interested buyer? You’ve opened the mailbox, and amongst the bills is a letter from a potential buyer who thinks your home is perfect. And they want to talk about selling your house privately.

What do you do?

You could be selling your house privately and save plenty of money and hassle! But there are considerable risks too.

Today I’m sharing two examples of recent common house offer letters from interested buyers in Melbourne, and my advice on what to do if you get a tempting letter in the mail.

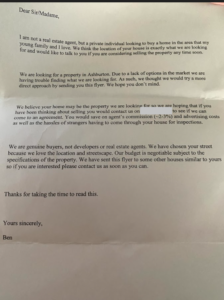

Letter one: Ashburton

Dear Sir/Madame,

I am not a real estate agent but a private individual looking to buy a home in the area that my young family and I love. We think the location of your house is exactly what we are looking for and would like to talk to you if you are considering selling the property any time soon.

We are looking for a property in Ashburton. Due to a lack of options in the market we are having trouble finding what we are looking for. As such, we thought we would try a more direct approach by sending you this flyer. We hope you don’t mind.

We believe the home may be the property we are looking for so we are hoping that if you have been thinking about selling you would contact us on XXXX (phone number redacted) to see if we can come to an agreement. You would save on agent’s commission (~2-3%) and advertising costs as well as the hassles of strangers having to come through your house for inspections.

We are genuine buyers, not developers or real estate agents. We have chosen your street because we love the location and the streetscape. Our budget is negotiable subject to the specifications of the property. We have sent this flyer to some of the other houses similar to yours so if you are interested please contact us as soon as you can.

Thanks for taking the time to read this.

Yours sincerely

Ben

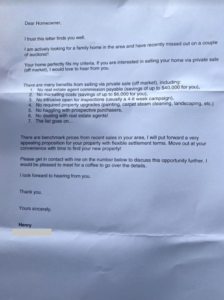

Letter two: Hampton East

The owner received this not long after a nearby property sold well above reserve at auction, with several bidders missing out.

Dear Homeowner

I trust this letter finds you well. I am actively looking for a family home in the area and have recently missed out on a couple of auctions!!

Your home perfectly fits my criteria. If you are interested in selling your home via private sale (off market) I would love to hear from you.

There are many benefits from selling via private sale (off market) including:

-

- No real estate agent commission payable (savings of up to $40,000 for you)

-

- No marketing costs (savings of up to $6,000 for you)

-

- No intrusive open for inspections (usually a 4-6 week campaign)

-

- No required property upgrades (painting, carpet steam cleaning, landscaping, etc)

-

- No haggling with prospective purchasers

-

- No dealing with real estate agents!

-

- The list goes on…

There are benchmark prices from real estate agents in your area. I will put forward a very appealing proposition for your property with flexible settlement terms. Move out at your convenience with time to find your new property!

Please get in contact with me at the number below to discuss this opportunity further. I would be pleased to meet for a coffee to go over the details.

I look forward to hearing from you.

Thank you

Yours sincerely

Henry

XXXX (phone number redacted)

When you get a letter like this, selling your house privately can be tempting

Both letters point out the many benefits of selling privately. You may find dealing with estate agents intimidating, and who doesn’t love the idea of saving money on unnecessary costs?

It seems like a win-win situation. The vendor gets your home at the market rate and you save costs on agent commission and advertising fees.

Fact checking the claims in these house offer letters

Before I give my advice on responding to these letters, let me correct the false statements. No matter how formal and professional the offer sounds, don’t trust the statements within as fact.

Claim one: commission is 2-3% in Ashburton

Fact: wrong. Agent commission for a family home would be about 1.5-2%.

Claim two: you won’t have to haggle with strangers

Fact: the person writing the letter is a stranger — you will most definitely be haggling with them.

Claim three: you will save up to $6,000 in marketing costs

Fact: marketing is usually more than this. The author of the letter doesn’t have an accurate understanding of typical costs when selling homes in your area.

Claim four: I’m speaking to others, so get in fast

Fact: this may be true, or it may be false scarcity. By making you feel you have to compete to lock in the buyer, you may be more included to make a hasty decision you will regret.

Interesting observations about both letters

Both letters are generic. They say they love ‘the street’ and ‘the area’ without specifying the name of the street or the name of the area. This makes it easy for someone to drop this letter in any mailbox in Melbourne. While they paint a picture of themselves being in love with your house, the details are sketchy.

The letters both indicate a strong interest in buying your home. But without inspecting the home, it’s very difficult to say what the true level of interest may be. So while the promise that ‘your home perfectly fits my criteria’ is appealing — how do they know? Perhaps you have a lime green 1970s kitchen that they won’t like. Unfortunately, t’s almost impossible to know the true level of interest until they inspect the property.

The letters don’t reveal much about the author. Both provide a mobile number and a single first name. So, we really have no idea where this house offer letter has come from. You can’t search the name of the author to find out if they’re legit. The author knows where you live, but all you have is a mobile number and a first name.

So, how do you respond to an offer of selling your house privately?

I suggest being extremely wary in your response. But if you’d like to proceed, please do your homework first. This is potentially the biggest financial transaction of your life, so it’s important to get right.

Before you respond, find out what your home is actually worth.

Agents offer free appraisals, so you take advantage and get advice on what would be an acceptable offer for your home. Prices fluctuate, and if you haven’t been following the market closely you may accept what you think is a good offer, only to realise later you’ve given your home away for a steal. Knowing the market price from a reputable local estate agent will give you confidence in negotiating (if you choose to do so).

Find out what the buyer is planning to offer you.

Before you agree to an inspection, you could reply to the letter, and find out the price expectations of the buyer. If they’ve gone to the trouble of writing letters to the neighbourhood, they should have an idea of what price they are willing to pay. They may argue that they can’t mention a price without seeing the property. You can always tell them the bedrooms and features of the home, or show them a comparable site listed online and ask them what they’d offer for it. This will give you a good understanding of the buyer’s budget intentions and stop time wasters who want to pay well below market rates.

Find out who they are

You’ve only got a name (or first name) and a number. Before you allow anyone into your home, you should know exactly who you are dealing with. It is not unheard of for burglars to pose as interested buyers to scope your house out. It’s a safety and security risk to let random strangers into your home. Once you know their identity you can research online to determine if their story checks out.

The biggest risk you face with selling your property privately

Though the authors highlight the benefits to the vendor of avoiding agents and inconvenient open houses, what they really prefer is a lack of competition. Most agents have interested buyers on their books and will get your property in front of potential buyers. Open houses, while inconvenient, also attract potential buyers.

Essentially, the person writing the house offer letter wants to avoid all that. But you, the vendor — you should love competition! Imagine auction day at your property, with two, three or more bidders hotly contesting for the keys. It drives up the sale price. It’s no wonder the author of the letter would prefer to deal with you privately — they can eliminate the competition and potentially get a bargain.

Agents have the experience you lack

Both the letters mention the benefit of avoiding estate agents. I get it, some people find agents intimidating. With agents being the third least regarded professions (behind advertising agents and car salespersons) you are not alone if you don’t trust real estate agents.

But put your opinions aside, and know these facts:

- if you shop around, you can find an agent you connect with, who you find trustworthy

- agents are extremely good at selling houses

- they have excellent insights into the market value of your house

- they know how to negotiate to get the best price

- they are well connected with buyers

So while you may save a bit of money by avoiding an agent, it’s often a false economy. Because agents bring all that experience (they know how to sell homes, after all) you are likely to get:

- expert advice on your pricing and sales strategy

- strong negotiations on your behalf

- all the open house inspections completed professionally

- access to their network of interested buyers

- advice on styling and preparing your home for sale

- strong vetting of interested parties (giving you peace of mind about who’s in your home)

- safe handling of deposit payments

- the best possible price

So while you might be tempted to avoid agents, there’s a reason agents exist and the great majority of homeowners trust them with one of the biggest financial decisions in their lives.

If you really do have an interested buyer, you can always agree to a price and get an agent to handle the final contract and deposit process. Some agents offer this as a service, giving you peace of mind that the sale negotiation is above board.

Who gets the savings?

Basically, both of the buyer letters both promise a saving in agents fees. But you may find that when time comes to negotiate the price, the buyer offers a reduced price due to the lack of agent commissions. So who’s getting the saving — the vendor or the buyer? In my experience, off market sales like this without a professional can lead to a reduced selling price. Which means that the buyer tends to get the saving of the commission, not the vendor.

You could get ghosted

It’s possible that a buyer can inspect the property and decide it’s not for them. If you’ve gone to the trouble of getting a section 32 and contract of sale with a view to a sale negotiation, you could be out of pocket. I’ve had clients who let people through the house and never heard from them again. In private, off market sales, you are still bound by the rules and regulations of real estate law, designed to protect both parties.

So, in conclusion, what to do if you get a house offer letter in the mail

- Get an agent to evaluate the market price

- Ask the buyer for price expectations

- Find out who the interested party is — check them out

- Consider the benefits of hiring an agent

- Proceed with extreme caution

- Negotiate a strong price, regardless of off-market sale

- Get an agent to handle the paperwork and payments (at the least)

Or better yet — don’t do it at all! You are far more likely to be better off selling your home the old-fashioned (and safer) way.

If a letter in the mailbox has you thinking about selling your home, our vendor advocate services can help you set a price strategy, secure an agent, negotiate a fair commission and get the best possible price for your home. We offer free initial consultations, so contact us to book a discovery call today.