by Melbourne buyers advocate, Carly Susic

Many home buyers ask me about how to buy a house before the auction. They’ve been to dinner and a well-meaning friend has told them to swoop in early with an offer. The assumption is that the vendor will be delighted by the offer. Not to mention the stress of auction day. Everyone wins, right?

Unfortunately, if you want to buy a house before the auction, it’s just not that simple.

So you should ignore well-intentioned but misinformed advice at dinner parties. Instead, read on to learn how some agents are using clever tactics to reject pre-auction offers for in-demand properties.

But first, understanding the Consumer Affairs price guidelines

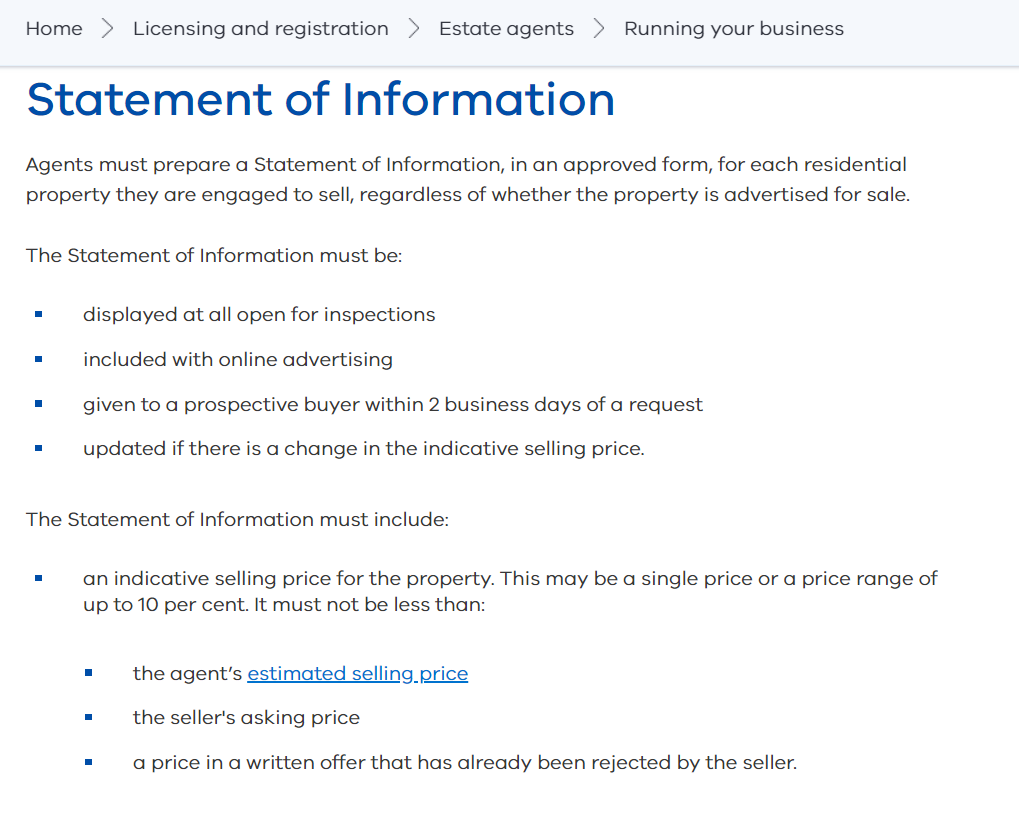

In a bid to crackdown on agents underquoting property prices, Consumer Affairs Victoria regulations specify that agents must adjust the price guide if the vendor receives and rejects a written offer prior to the auction.

This is best explained with an example.

Let’s say that a house is listed with a buying guide (otherwise known as an indicative selling price) of $1.5 million. An interested buyer submits a written offer of $1.7 million, well above the quoted price. But the vendor rejects the offer. According to CAV rules, the agent must then change the buying guide. It should now reflect the true price expectations of $1.7 million.

Here’s a screenshot from consumer affairs about the regulations on underquoting

How agents get around the CAV guidelines

Agents don’t want to change the buying guide.

There’s an industry saying: quote them low, watch them go. Quote them high, watch them die.

Agents love to appeal to a broad market by quoting low. Ideally, the buyers then compete at auction and the property sells for far beyond the quoted price expectations.

I’ve spoken to several agents who use a clever strategy to work around this regulation. When a vendor signs the contract with the agency, they also sign a form, agreeing that they will not accept offers prior to the auction.

It’s worded like this:

I/we will not consider enquiries before the auction.

Please inform all buyers that I/we will not consider offers or enquiries made before my auction.

This gives the agency the power to reject offers. They argue that the rejection is not based on price. Instead, the rejection is due to the instructions from the vendor that no offers submitted prior to auction will be accepted. This means that agents are free to reject the offer without amending the indicative selling price. (Or so they argue.)

Not all agents do this

Many agents will adjust the indicative selling price if they reject a written offer that is higher than the quoted price. Firstly, they believe it’s the right thing to do — they don’t want to mislead buyers. Secondly, they don’t want a penalty with Consumer Affairs Victoria. Penalties include:

- hefty fines, up to $31,000

- losing commission on the property sale

- having to advertise in the local media (and in their own office) that they’ve been caught underquoting

Naturally, agents want to avoid this, so many do the right thing.

In my view, there is a loophole in the regulations that some agents are exploiting.

One agent told me that they are including the standard waiver form with every single sale contract with vendors. Just because they ask vendors to sign the form, doesn’t mean they don’t intend to update the indicated selling price if they reject an offer prior to the auction. But it’s there to protect them if they do.

So what can you do about it, when you want to buy a house before the auction?

Unfortunately, not a lot.

My best advice is that you should get ready to go to the auction. Save yourself the stress, hassle and potential disappointment of placing an offer prior to auction.

If you’d still like to try, speak to the agent before taking action. Ask the agent if the vendor is accepting offers prior to the auction. Or you could be more specific. Ask the agent if the vendor has given written instructions to reject offers prior to the auction. This way, you’ll know beforehand whether the pre-auction offer is a waste of time (it probably is).

Another reason to avoid pre-auction offers? You let the agent know your budget.

Let’s say you place an offer. But you’re rejected, not because the offer is too low. Because the agent has been directed by the vendor, in writing, that pre-auction offers won’t be accepted. So you arrive at the auction, ready to bid. Let’s say the auction is sluggish, and the property passes in at a price below your original bid. The agent now knows your price range. They’ll be in a strong negotiating position to talk you up to that price expectation. (Agents are very skilled negotiators.)

Never give your budget expectations away unnecessarily.

The other danger with pre-auction offers

Agents can mislead you. They tell you there’s interest from another party and invite you to name a higher price. But unlike the auction where you can see who’s bidding down the street, you are in the dark here. Unknowingly, you may be bidding against yourself.

This is why, in general, I suggest avoiding pre-auction offers, because:

- If there are other buyers with strong interest agents are likely to reject them, using the vendor waiver form

- you show your budget to the agent (leaving you exposed)

- you are unlikely to be successful, unless your offer is well in excess of the indicative selling price

- if your offer is acceptable, they don’t just sell it to you without inviting other buyers to contest your offer (thus creating an boardroom auction)

- There is more transparency when bidding in the open at the auction, instead of in the dark, pre-auction

So to answer the question, can I buy a house before the auction?

In many cases, the answer is no. However every scenario is different, including the number of interested buyers and if vendors are accepting offers prior to the Auction. If you want to buy a property before auction, do your homework and ask the agent how they will be handling offers prior. Knowing this is essential so you don’t get caught out in a situation you were not expecting. Making offers prior to the auction will not exclude other buyers from doing the same, so it’s wise to expect this outcome. If so, you’ve effectively taken the auction off the street and into the boardroom.

However, be mindful of this scenario

If you are the only interested buyer, the agent may try to sell before the auction. The agent knows that the auction will be a fizzer, so tries to lock you in early. If this happens to you, it may be wiser for you to wait till the auction. If the home gets passed in to you at the auction, you are then in a strong negotiating position.

If you need help formulating a buying strategy, we can help. We negotiate with agents and help you buy the right house at the right price and the right time. Contact us for a free one hour consultation.